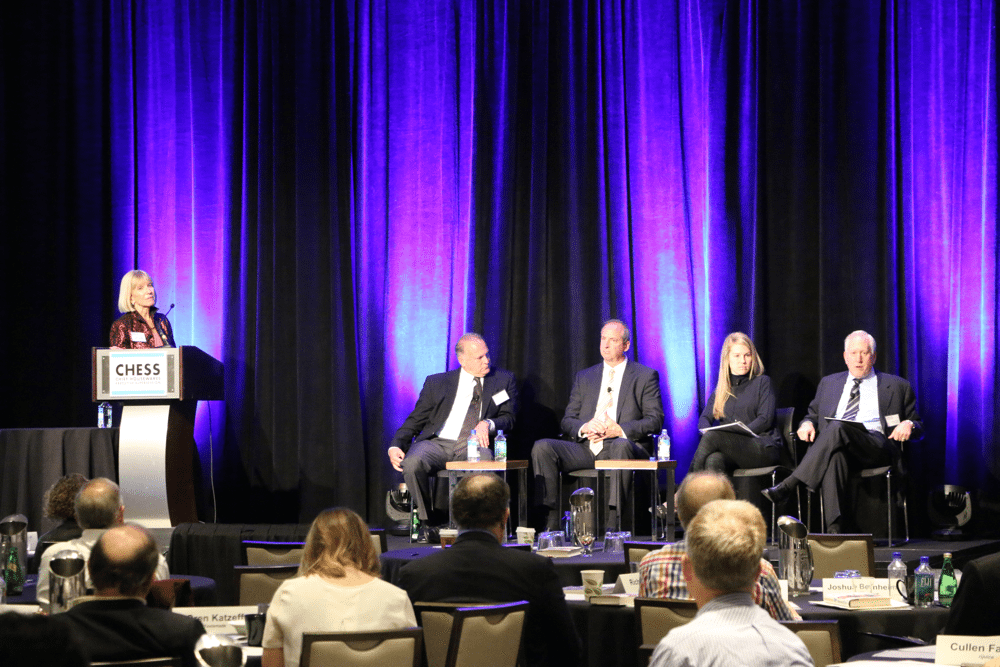

Day Two: Session Three

So You Don’t Want to Sell Your Business…How Do You Get the Capital to Grow It?

Moderated by Linda Graebner, Executive Chairman, Chef’n Corporation

Panelists: Katie Fitzgerald, CircleUp Network, Inc.; Ted Koenig, Monroe Capital LLC;

Bruce Lubin, The Private Bank and Jon Lucas, President, CIT

Last year’s panel suggested “Everyone Should Sell Their Business At Least Once” and presented tricks of a successful sale. But now you’ve decided to grow the one you have instead. This diverse panel of experts addressed the critical elements of a business growth plan: the elements of a business strategy that attracts investors and several different approaches to consider for financing your plan. Panelists identified ways to distinguish your company and its opportunities to achieve your plans.

Graebner began by summarizing the results of a survey of members seeking capital advice. She then invited the panel to outline their services and offer guidance.

Lubin: Today the financial climate is in your favor—there is no better time to get financing. Get your business plan in order, be prepared andbe open. Have a relationship with your banker to get to know them when you don’t need anything and so that you can trust them. When you do need something you want the person to understand your business.

Lucas: Focus on what you offer and what sets you apart. CIT specializes in the consumer product industry. We focus on $5-100 million companies that sell into retail distribution. We have clients in the audience. We have a deep understanding of your business and understand your customers. We know your customer base and the games they play. So when you hit bumps in the road, we can provide financing to help you to get to next stage.

Koenig: At Monroe Capital we are temporary partners; we provide capital and are not a bank. We can be flexible and can partner with banks to assist with a piece of the capital structure. We work with middle market companies starting at $3 million EBITDA. Our loans are based on cash flow and enterprise value, not accounts receivable or value of equipment, real estate or personal net worth. We provide capital so you can do the deal you want to do: acquisitions or intra-generational transfers, as when family members sell to one another.

Fitzgerald: CircleUp is a different platform for raising capital. Existing capital markets are inefficient for companies that don’t fit intotraditional boxes. We believe investor diversification should include more than just public market investing. We focus on U.S. consumer products companies that typically have more than $1 million in revenue for the current fiscal year. Our companies have a tangible product or retail outlet that you can touch, taste, use or visit. We build a community of investors who back a company individually and collectively and can help a company grow beyond just the financial contribution. Online communication allows entrepreneurs to connect with people who know your business and people beyond your network or who your banker knows. Online documentation and diligence means more transparency and we curate companies that make it onto our platform.

Graebner: What should companies do before contacting you?

Lubin: Some companies come unprepared and don’t know what they are looking for and what they have to offer. Someone who comes to see me has to be succinct and have the information I need, like three years of financial statements. I want to hear the story realistically to see if I can satisfy your needs. My market starts at $15 million of revenue. Be prepared, succinct and open. For a company with less than $50 million in sales, I find that a smart entrepreneur hires a good financial officer and accountant. If you want to grow, it’s critical to get a CFO. It’s your business to know what sells, but a financial officer understands our language and can explain your cash flow and present your business plan effectively. We invest in the business plan and we need to understand our commitment.

Koenig: You know your sales and customer service, sourcing, importing, manufacturing. But how reliable is your earnings stream? Can the business function without you? The biggest challenge for company leaders is to plan for your own transition while you are still the most important person in your business. Lenders won’t put debt into something if only one person contributes to value or if a company has one major customer with 40-60% of customer base; that’s a concentration of risk. You don’t want to be in that spot. We look at the management team and want to make sure we have a solid business with an alignment of interests.

Fitzgerald: Who doesn’t make the cut for financing? Companies that come too late, when in dire need. That’s never a good start. Plan for cash flows in advance. It can take several months for investor conversations to raise capital. A common mistake is evaluation: an entrepreneur thinks his business is worth $100 million but isn’t there yet. You raise capital for where the business is today. Investors are taking on risk, so market evaluation is important. Avoid tying yourself up with one or few investors too early, especially at early stage, because that investor might drop out. Early stage exclusivity is not required.

The panel then took questions from the audience on topics such as EBITA, evaluations, capital structures, personal guarantees and varying types of risks and ESOPs.

Their final tips:

Fitzgerald: There is a lot of capital available and many options for entrepreneurs. Explore those and don’t limit yourself and find the right partner.

Lubin: Loans are repaid by people. Get to know your banker or finance source.

Lucas: Diversify your product lines and customer mix.

Koenig: Think long term. Determine what is your core business and then decisions will fall into place.

To learn more about the panelists, see