One of the world’s most dynamic trading relationships exists between the U.S. and our neighbor to the south, Mexico. With approximately $ 1.5 billion in goods crossing our borders daily, Mexico is the U.S.’ third largest trading partner and second largest export customer.

Much of Mexico’s economic progress in recent years has come through the integration of the North American market including the U.S. and Canada. These deepening ties among manufacturing, agriculture and service industries in the NAFTA area have helped to create pro-growth market conditions and vibrant business and consumer demands that are being experienced today.

The upcoming Global Forum in Mexico City offers members of IHA’s International Business Council a great opportunity for gathering – to affirm existing relationships, and also to initiate new business connections while visiting a hospitable, adjacent market that is primed for solid growth.

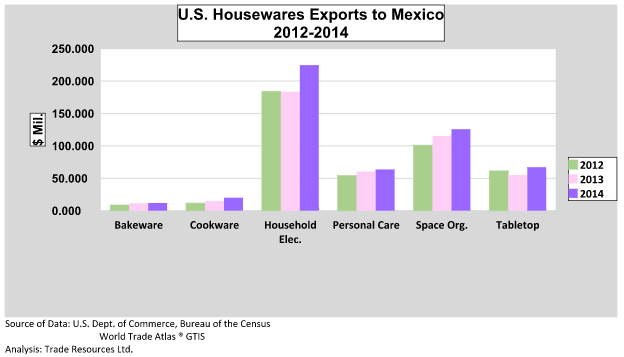

In 2014 U.S. housewares exports to Mexico totaled $513 million which represented 16.5% and 21.9% gains over 2013 and 2012 respectively. Ranking second only to Canada in terms of market size, Mexico currently holds 11% of U.S. housewares export market share. This trend is steadily increasing.

Every category of housewares exports to Mexico increased in 2014 compared to 2013. Bakeware rose 3.5%; cookware grew 35%; the largest dollar volume category – household electrics – soared 22.4%; personal care increased 5.3%; space organizers gained 9.1%; and tabletop rose 21.9%. The actual dollar values are displayed in the table below.

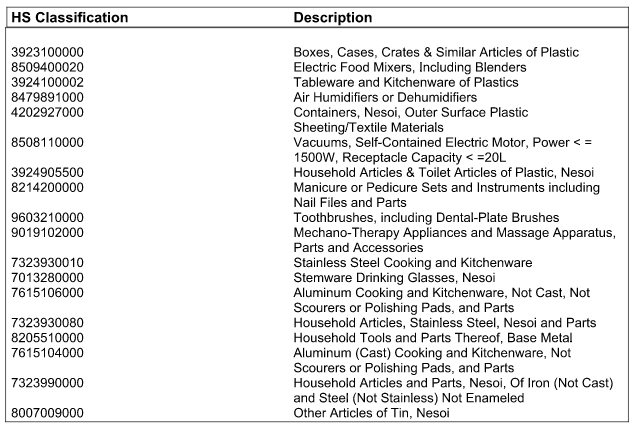

With a largely urban population of 120 million persons and a median age of 27 years, nearly 55 percent of Mexicans are considered wealthy or middle class. Per capita income is $15,600 and consumers are increasingly better educated. Combined with large scale diverse infrastructure programs that include new housing developments in urban areas throughout the country, the current and future prospects for increased housewares demand is very favorable. For example U.S. housewares products that demonstrated sizable sales in Mexico in 2014 are:

Some current market conditions to be aware of when further developing your business strategy in Mexico are:

- The GDP growth rate at 2.4% is anticipated to rise over the 2-3 years. Inflation is relatively low.

- Mexico is seeking to become competitive globally by engaging in reforms in key areas such as labor, finance, education, telecommunications and energy policy. These efforts are enabling Mexico to create a case for effectively competing with Asian economies and which in turn should help to grow its internal economy.

- The National Infrastructure Program of 2014 worth nearly $600 billion representing public/private investments in transportation, communications, water treatment, public health, housing and urban development and tourism will influence even more global investor attention toward Mexico.

- Quality of life standards are improving in Mexico. Initiatives in support of green buildings, LEED certification and sustainable development are in demand.

- Upgraded transportation networks via roadways, ports and airports will help ensure efficient product distribution, particularly at heavily trafficked border crossings like Laredo/Nuevo Laredo, Ciudad Juarez and Tijuana.

- There is an historic and increasingly shared culture with the U.S.

- Mexican consumers like and demand U.S. products and new technologies.

- Communications systems are excellent.

- Mexico has adopted a pro-active posture in negotiating free trade agreements with other countries and trading blocs. This positioning should help Mexico to be flexible on a global basis as a viable platform for business. Currently, the TPP (Trans-Pacific Partnership) is being negotiated in which the U.S. and Mexico are partnering with nations accounting for over 40% of global trade. The anticipated results of TPP are business expansion and trade development for both nations.

- The Federal Government is a stable democracy and the relations between our leaders, Presidents Obama and Nieto, is open and agreeable.

Other practical considerations for your market planning in Mexico at the micro/firm level are:

- 93% of the populace speaks Spanish; therefore, marketing materials should be translated into Spanish. It will be beneficial for houseware company officials to know a little Spanish and for your agents/distributors to be fully conversant in the language.

- Mexico covers a large geographic area. Housewares exporters should take time to qualify and engage more than one agent if coverage is desired for the entire market; and if warehousing is needed, should aim to evaluate stocking distributors with the logistics, customs and marketing experience desired. At the same time, housewares exporters are responsible to develop a serious working relationship with your agents/distributors including providing support in terms of product training, marketing support, adequate samples, technical support and parts as needed.

- It is fine for business to get started by email or other written form of expression, but developing a lasting business relationship should take place directly by telephone and in person.

- Over 100 million cellphones and 20 million landline phones are in use in Mexico, and they are growing in terms of popularity for marketing purposes, as is the internet with over 45 million users. Print publicity and retail point of purchase displays are popular and telemarketing is gaining as a marketing strategy.

- Large international companies, retail or otherwise in Mexico, may try to replicate the marketing strategy that they employ in their home and other international markets unless that is proven to be ineffective. Mexican consumers may look to do business with such companies where they know what to expect in terms of marketing practices and quality standards.

- Access to credit has been difficult for the past few years and it has particularly impacted small-medium size Mexican importers that may seek longer payment terms from housewares exporters. Mexico lending rates are higher than in the U.S. and you may consider having a U.S. Commercial Service office conduct a background check on potential partners as part of your due diligence.

- Similarly, the Mexican legal system is different than the U.S. system and housewares exporters should consult qualified counsel before contracting with Mexican partners.

There are good reasons for experienced housewares exporters to continue growing business in Mexico and for new-to-market exporters to plan market entry. Mexico is a youthful market with a dynamic future. Mexico has succeeded in identifying and overcoming problems as it continues improving. At the same time the North American market is establishing itself as an effective strategic economic partnership. Your time and energies are well spent with our neighbor to the South! Enjoy the Global Forum!

Report and analysis by: Laura Spingola, Trade Resources Ltd., Chicago, IL +1.312.939.5030 / LSpingola@TradeResources.com